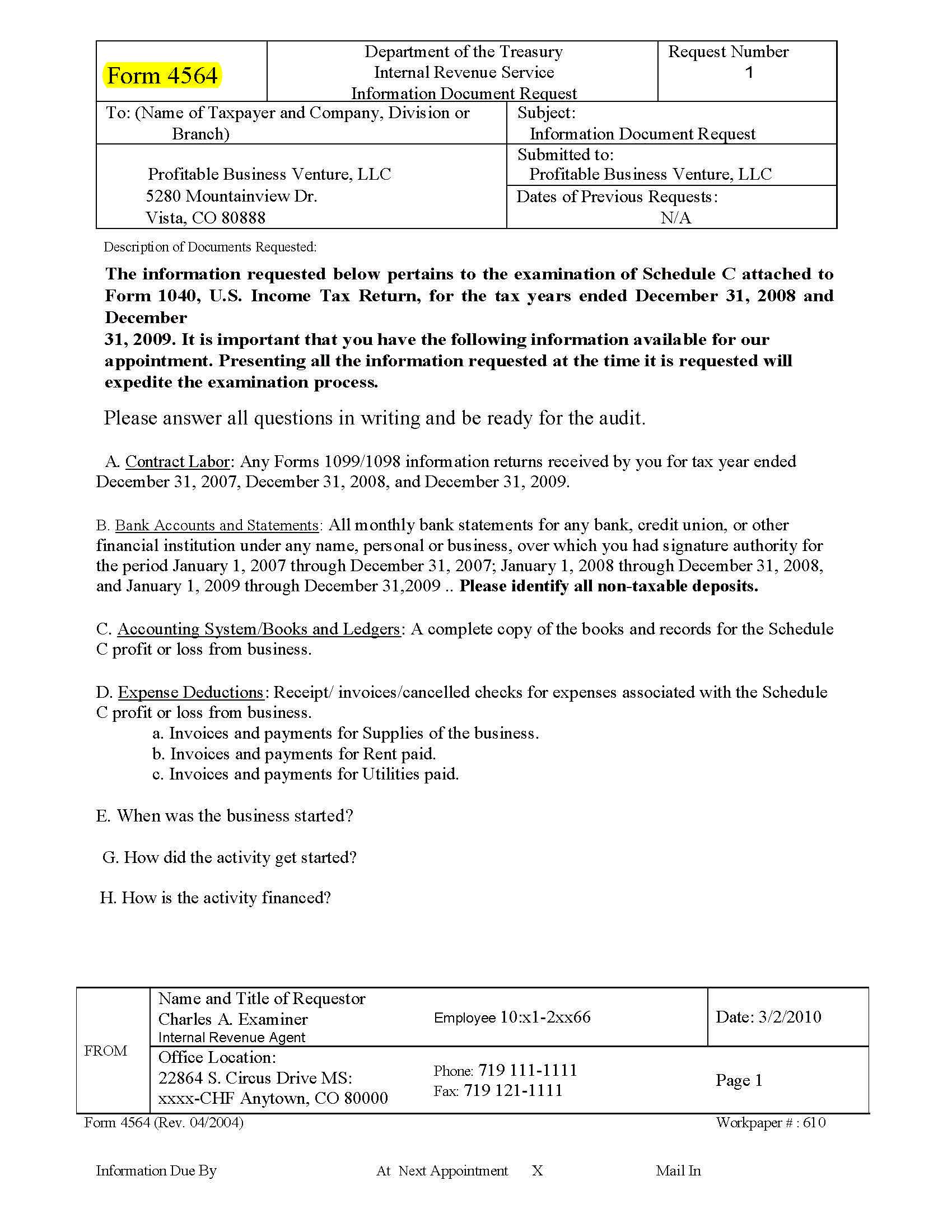

The IRS serves you with Form 4564 when they seek a detailed examination of you. They usually request much more information from you than they need - but you have a duty to prove your case. This is an extremely important document.

Often included with the Form 4564 will be a Form 886A which contains explanations & further requests for information. The IRS will want their questions answered by you!

Since an IRS audit is a Federal investigation of you, you are required to prove every element of your case in the format required by the IRS or be rejected. It takes a lot of work, even if you have accounting software. You need to get organized & get legal advice. Each must be as cost-effective as possible.

Income Issues:

Essentially, the IRS will look at all your bank account information, your business deductions & expenses, your Wage & Income Transcripts & your lifestyle to determine if you accurately accounted for your income & expenses on your tax return.

Call the Agent or go online & request your "Wage & Income Transcripts". These documents contain all 3rd party records sent to the IRS on you. Your spouse (& children, perhaps) should order their transcripts as well. You can verify the entries on your return.

The IRS will declare all income in your bank account to be income unless you prove otherwise. You have to track all inter-bank transfers & other deposits that are not income, such as loans, inheritances, gifts, etc. Fortunately, the TaxHelpAudit membership has an entire section devoted to "How to Prove a Deposit is Not Income", which shows you specifically what to get & say to the IRS!

The IRS will review your lifestyle & assets to roughly determine if it corresponds with the the income reported on your return.

Deduction Issues:

Often, the IRS will reject insufficient or poorly organized records & offer little explanation for why or how you can repair them. The IRS is not allowed to give you legal advice or tell you how to arrange your records. You must give the IRS evidence of titles, insurance, bank statements, purchase documents, vital records, court records, etc., not just a pile of receipts or even an accounting software program. And, the evidence must be arranged in exactly the manner required.

So, most people lose because the don't know how to respond. Plus, the IRS will impose penalties on you for poor record-keeping and/or accuracy-related, & negligence along with ever-growing interest charged against you. To avoid this result, the TaxHelpAudit Program shows you exactly what to gather & what to do for all IRS audits.

Don't let them intimidate you. Keep a direct course proving your case, be extremely thorough with your documents, bring up new issues in your favor & narrow down the IRS inquiry with procedural barriers. But, you must present your evidence in the manner which the IRS requires or you will be rejected & no attorney in the world can help you.

This process requires thorough organization. So,the TaxHelpAudit program shows you exactly what to give the IRS & what to say - for every issue & every line on every form! And, the TaxHelpLaw Tax Attorney, J. David Hopkins, JD, LLM gives you guidance or advocacy along the way!

To see how the TaxHelpPrograms work see our Empowerment page!

Steps for IRS Audits

Please look carefully at your Form 4564. If the IRS questions relate to your Schedule C, Form 2106 or Schedule E, then please follow the TaxHelp Business Edition Prep Steps.

If the IRS questions relate to your Schedule A, Form 1040 or the please follow the TaxHelp Individual Edition Prep Steps. With both, you get the full TaxHelp program and the Form 1040. The TaxHelp Audit program gets you prepared & saves you time!!

Lost Documents: Often, people are fearful of an audit because they didn't keep their records or the records are lost or unavailable. However, unless you dealt solely in cash, bank records & credit card records can be re-created. Even if you used a lot of cash, we can get affidavits or use industry standards to arrive at a reasonable figure. See TaxHelpLaw Lost Documents.

Call a TaxHelpLaw attorney at any time!