Since the purpose of Form 886A is to "explain" something, the IRS uses it for many various reasons, but most often to request information from you during an audit or to explain proposed adjustments in an audit. This form is extremely important because the IRS will want their questions answered by you!

You will need to provide more than just a few cancelled checks to the government. Each item of your return being questioned by the IRS must be proven with specificity & in the proper format or you will be rejected. You need to get organized & get legal advice.

But, only you can effectively gather your documents because only you have authority & control over the documents. It is less expensive & more efficient for you to prepare your own documents. So, the TaxHelpLaw attorneys have designed TaxHelpAudit to teach you how to gather & prepare your documents & evidence. Then, the TaxHelpLaw attorneys can better advocate for you!

Steps for IRS Audits

The number of documents the IRS requests from you is often far more than needed to prove your case. They are "fishing" for more information. To protect you, TaxHelpAudit shows you exactly what to give them & what to say - for every issue!

Income Issues:

The IRS will review your "Wage & Income Transcripts", your bank account deposits & your lifestyle to determine the accuracy of your reported income. The Wage & Income Transcripts are all third party documents filed with the IRS on you, such as Employers, Banks, & Lenders. You should obtain a copy of these documents from the Agent or by going online.

The IRS will declare that all your bank and other deposits are income unless you can prove otherwise. This takes some effort to prove with proper documentation. So, an entire section of the TaxHelpAudit Program is dedicated to "How to Prove a Deposit is not Income".

Also, the IRS will look at your personal expenses & assets to determine if your income supports your lifestyle.

But, typically, the IRS disputes your income by sending you Return Error Notices (See TaxHelpLaw.com). In an Audit the biggest issue is when the IRS denies you proper deductions.

Deduction Issues:

Often, the IRS will reject insufficient or improperly organized documents & offer very little explanation for why or how you can correct it. The IRS will not (& by law, cannot) give you legal advice or tell you how to arrange your records. Yet, you are required to prove your case entirely.

You can't just give the IRS a pile of receipts or even an accounting software program. You must gather titles, vital records, employment records, bank statements, purchase documents, court & public records, etc., to prove your case. If your records are not arranged correctly or the evidence is insufficient, the IRS will reject the deductions & likely impose a "negligent record-keeping penalty" as well as the "accuracy-related penalty".

So, pay close attention to the lines of your return or Schedule being questioned. These must be proven with full & exact specificity. Our Programs give you close guidance on every issue, on every line of all common IRS Forms or Schedules, with every bit of evidence necessary to fight the IRS!

To see how the TaxHelp Programs work view our Empowerment page!

Lost Documents:

You may fear an IRS audit because you didn't keep your records or your records are lost or unavailable. However, unless you only used cash, we can re-create your bank & credit card records. Also, even if cash was used, affidavits can be obtained or we can use industry standards to arrive at a reasonable figure. See TaxHelpLaw - Lost Documents.

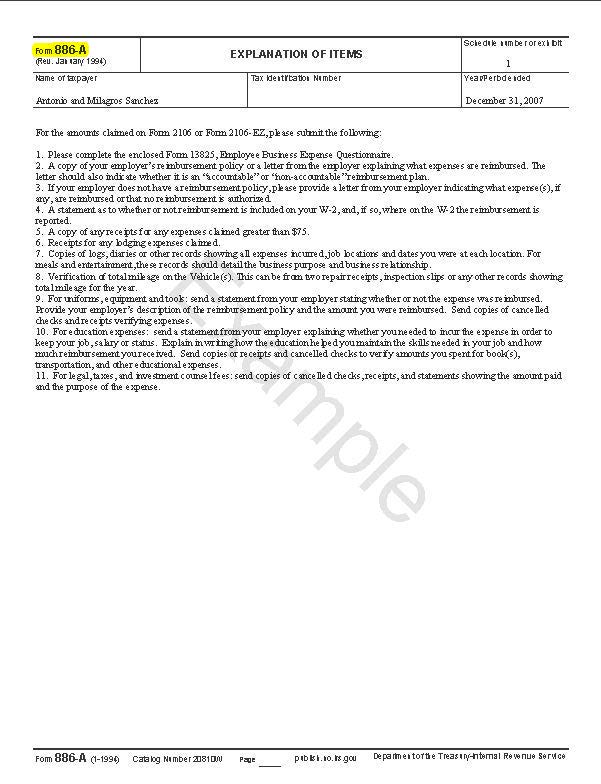

Please look carefully at your Form 886A. If the IRS is requesting information related to your Schedule A, Schedule D, Schedule B, Form 1040, Schedule D or the Form 4797, please follow the Individual Program Prep Steps, or each separately.

If the IRS requests are for Schedule C, Schedule E or Form 2106, please follow the Business Program Prep Steps! In any event, to get your records in order & respond correctly please follow the TaxHelp Prep Steps for victory!!

At any time you may consult with a tax attorney from TaxHelpLaw to get more specific tactics for your case!

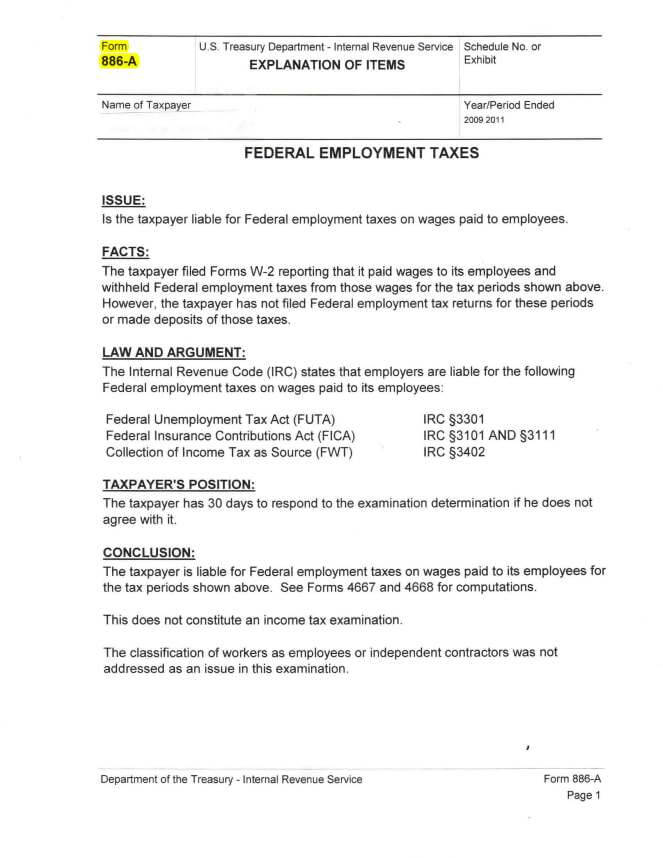

IRS uses Form 886A to request items in an audit:

IRS uses Form 886A to explain proposed adjustments: