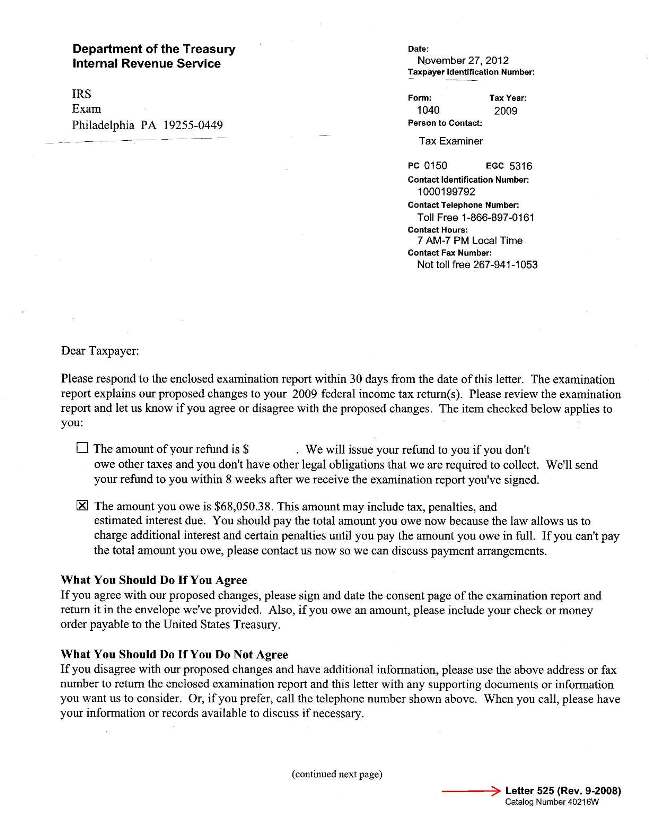

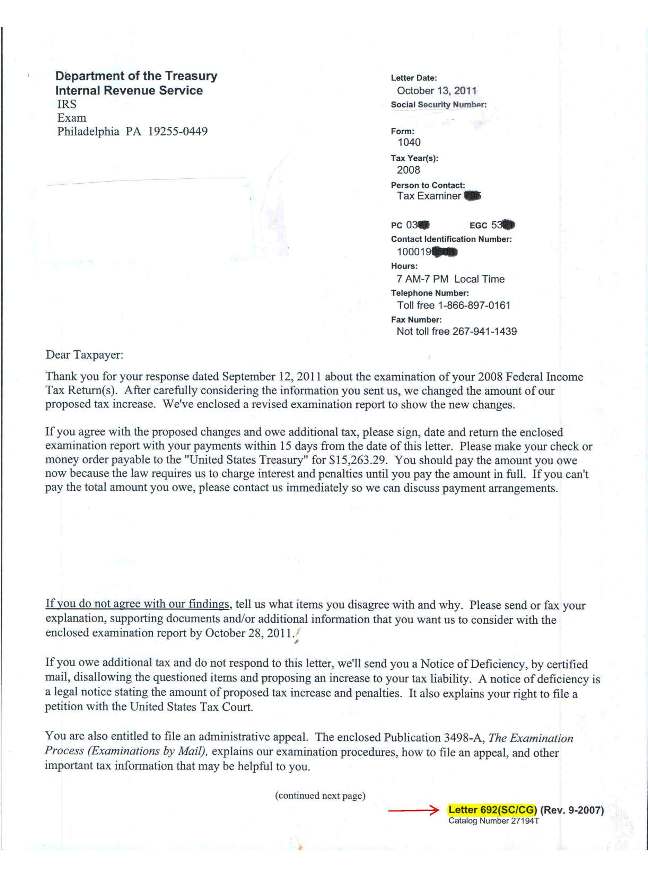

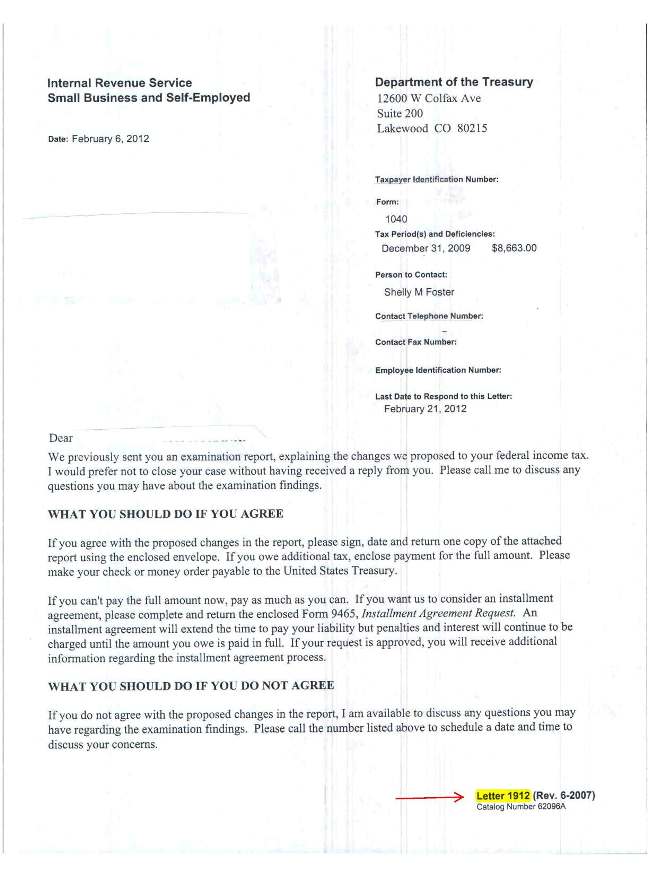

IRS Letters 525, 692 & 1912 are just cover letters for a Form 4549. They outline the processes to take whether you agree or disagree with the findings. Please do not sign the Form 4549 without legal advice. An IRS audit is a legal process of investigating you.

The best way to handle any legal process is to 1) prepare your case and 2) consult with an attorney.

Steps in Response to an IRS Audit:

To prepare your case you must get your records organized. You can do it yourself or hire a CPA or us. If you want to save the money of hiring a CPA, the least costly method is to purchase one of the the TaxHelpAudit.com programs. These programs show you with video, audio & publications exactly what to gather and how to arrange ALL your documents. You'll save a lot of time & money!

During this legal process, you may seek the guidance of TaxHelpLaw to warn you of the IRS traps and for tips or representation.

As explained in the Form 4549 page, you can present other evidence or law to the IRS agent or Appeal the decision within the IRS or in Tax Court.

The IRS usually has 3 years to audit you. If time is running out, they will likely ask you to sign an extension (Form 872) so they can continue to examine you. Please do not sign this without legal advice, either. We generally do not grant extensions to the IRS.

Of course, you may always call Mr. Hopkins at TaxHelpLaw for legal advice along the way!