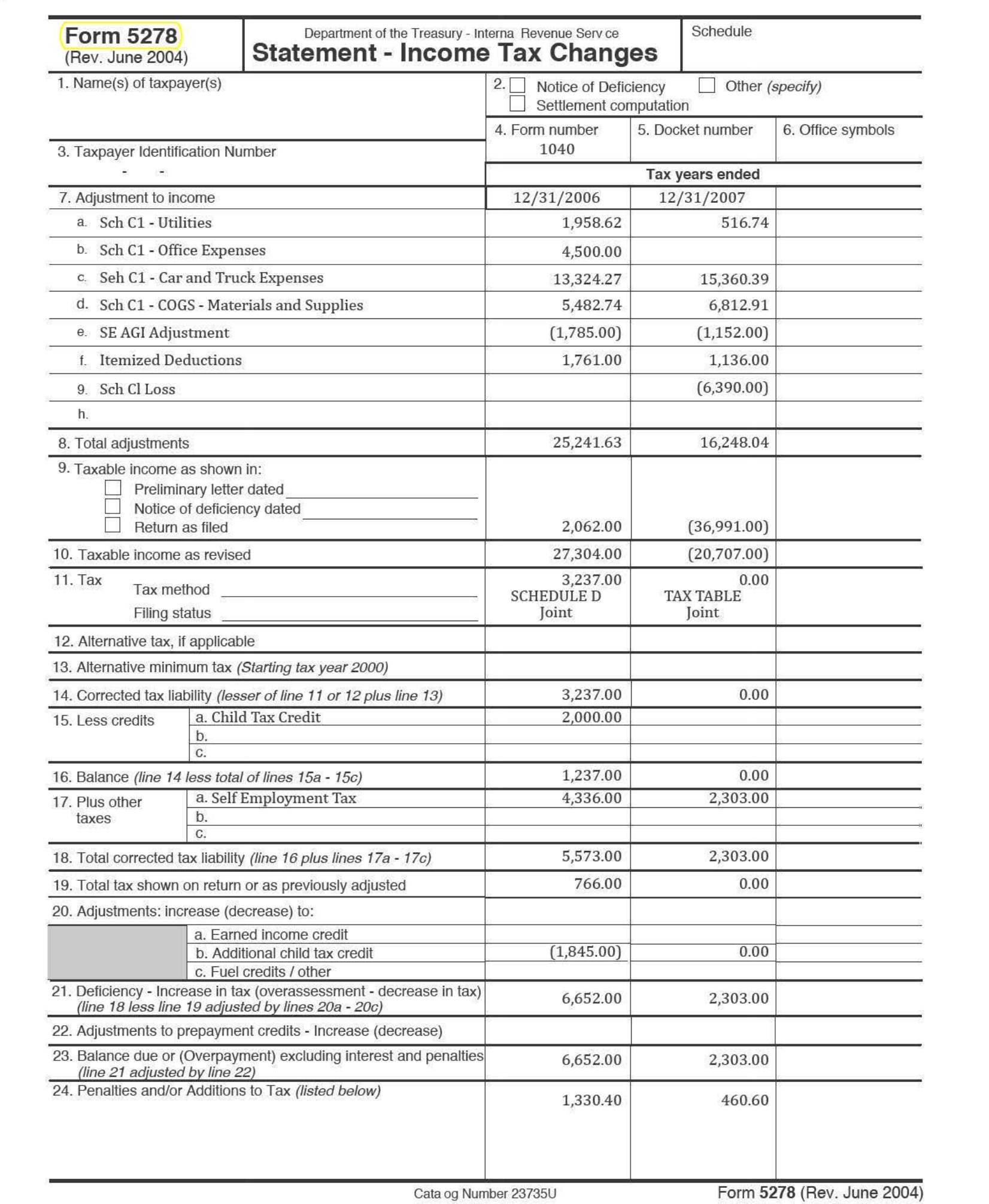

If the IRS is not satisfied with your audit response they will issue you a Form 5278 to propose that you owe more taxes. It may come attached to a Form 4549. This is only a proposal & they may issue revisions if you present further evidence. But, the case remains "unagreed" at this point.

Supposedly the IRS must examine your records before they issue a Form 5278. But, often times, it seems they ignore your evidence or reject it with little or no explanation at all.

If the IRS says you owe more taxes they will often ask you to sign and agree to an assessment. TaxHelp recommends investigation, advice and resistance to signing Form 5278, unless you totally agree. The Tax Attorney at TaxHelpLaw, J. David Hopkins, JD, LLM, can give you guidance.

Steps in response to Form 5278:

At this point, you have the options of: 1) paying the bill, 2) presenting further evidence, 3) appealing to the agent's manager, 4) Appealing to IRS Appeals, or 5) waiting for the IRS Notice of Deficiency and petitioning Tax Court. TaxHelp believes the Tax Court is more fair to taxpayers than the other forums.

In all events, you must arrange and present your evidence for review - at any level. The TaxHelpAudit Program gets you prepared at all levels.

To see how the TaxHelpPrograms work see our Empowerment page!

Income Issues: The IRS reviews your Wage & Income Transcripts as well as your bank records & lifestyle to determine if you accurately accounted for your income. This is sometimes, but not often, an issue. Order your Wage & Income Transcripts from the IRS Agent or by going online so you can compare them to your records.

The IRS will assume all deposits into your bank account are income, unless you can prove otherwise. This is a very tedious chore. But, Members of the TaxHelpAudit Website have access to the section titled "How to Prove Deposits are Not Income" to make this task easy.

Deduction Issues: Very often, the IRS agent simply rejects all your business deductions & offers little explanation for doing so. But, obviously he or she is either lazy or did not believe the evidence was sufficient or organized properly.

If your evidence is insufficient or isn't presented properly, it will be rejected by the IRS. The IRS cannot give you legal advice & will not tell you how to properly organize your evidence. Look at how meager & worthless are the IRS' "tips" on preparing for an audit.

Each IRS question has its own unique evidence requirements - you can't simply present a pile of receipts & cancelled checks or even an accounting software program. The IRS won't look at improperly organized documents or insufficient evidence & they likely will impose a "negligent record-keeping penalty" and/or the "accuracy-related penalty" on you as well.

The IRS will want to review many other documents, such as titles, insurance policies, vital records, purchase & transaction documents, license information, employer records, etc. Each issue has its own unique requirements & you must be totally prepared.

At a cost, you can hire a bookkeeper, CPA or lawyer to prepare your evidence but they don't know your business or have the authority or ability to get the documents you will need for the IRS. It's cheaper, easier & faster if you prepare your own records.

That's why the Tax Attorneys at TaxHelpLaw designed the TaxHelpAudit program - so their clients could get properly organized & the attorneys can more effectively advocate for them!

The best (& cheapest) approach to an IRS audit is to completely organize your documents & then seek legal advice prior to any IRS meetings.

Lost Documents: You may not want an IRS audit because you didn't keep your records or your records are lost or unavailable. However, unless you only used cash, bank records & credit card records can be re-created. Also, even if cash was used, affidavits can be obtained or we can use industry standards to arrive at a reasonable figure. See TaxHelpLaw - Lost Documents.

Please carefully review the issues on your Form 5278 or the requests for information the IRS sent you with Form 4564 or Form 886A.

If the questions relate to a Schedule C, Form 2106 , or a Schedule E, please follow the Business Program Prep Steps.

If the questions relate to your Schedule A or Form 1040 please follow the Individual Program Prep Steps.

At any time you may consult with a tax attorney from TaxHelpLaw to get more specific tactics for your case!