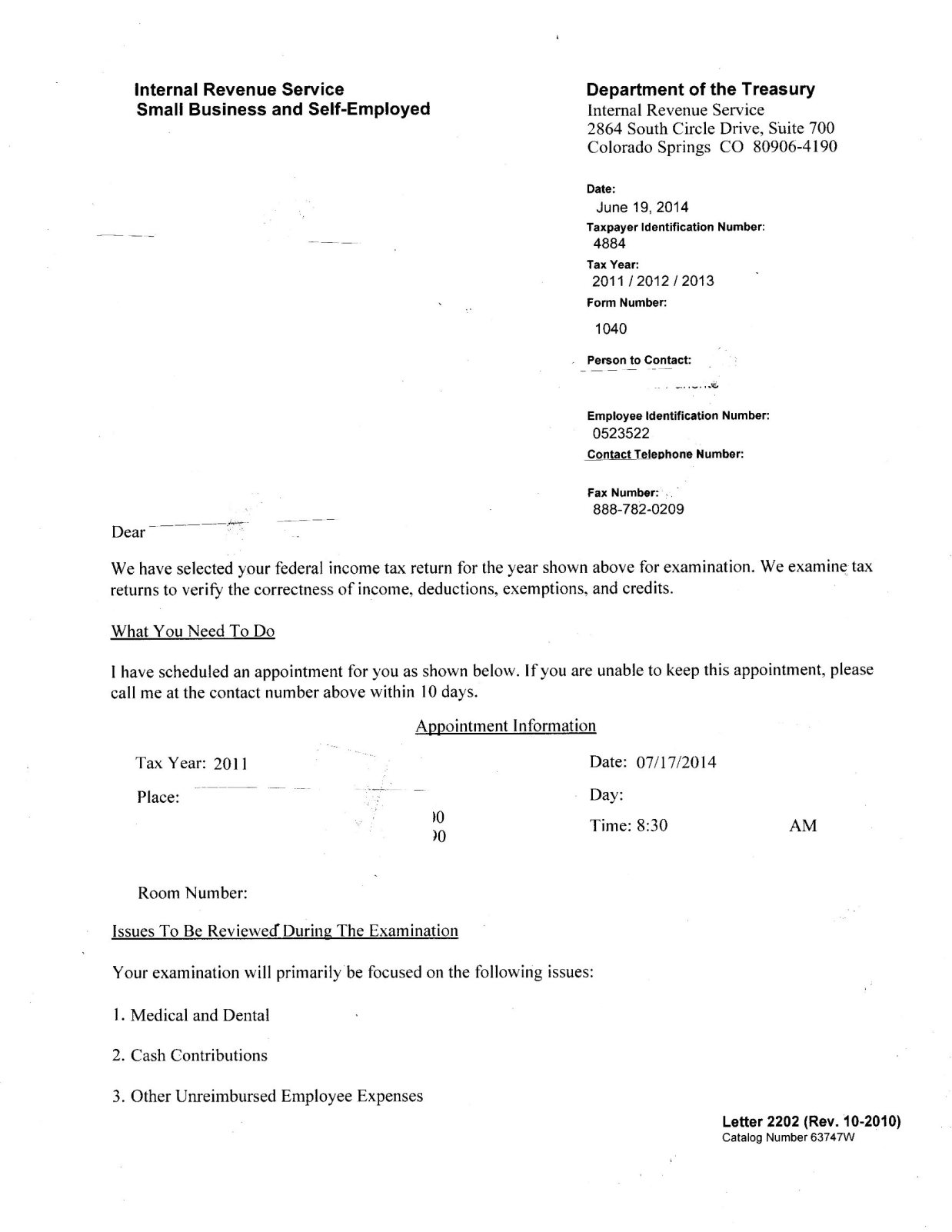

Letter 2201A has been retired in favor of the new Letter 2202, which mirrors Letter 2201A exactly. Just like Letter 2201A, the IRS uses Letter 2202 to inform you of an audit. Usually this form is used when they want to visit with you in person - either at your home or business or in their office. Consult with J. David Hopkins, JD, LLM at TaxHelpLaw for Tax Attorney advice if necessary.

Steps for IRS Audits

The IRS could have outlined the issues on the front page of the Letter 2202 but they often use Letter 2202 in conjunction with Form 4564 or a Form 886A to request information from you. It is very dangerous to meet with the IRS. So, before you contact them please look at the Form 4564 or Form 886A you received to find out what to do next to save time and money!

The IRS will want you to answer their questions so legal advice is advisable. They usually review your bank accounts & other evidence of income but more often, they deny your deductions, without looking at them. If your records are not properly presented, the IRS will reject them & likely impose a "negligent record-keeping penalty" and/or an "accuracy-related penalty" on you as well. (See IRS Notice 746)

The evidence required to prove your case can be vast & it must be presented in the format required by the IRS or you will be rejected. Realistically, only you can get the evidence because only you have all the information & authority.

You must get organized & get legal advice at the least cost. So, the TaxHelpLaw Attorneys have designed the TaxHelpAudit program to get you prepared so TaxHelpLaw can more effectively advocate for you!

Lost Documents:

Perhaps you fear an IRS audit because you didn't keep your records or your records are lost or unavailable. However, unless you only used cash, bank records & credit card records can be re-created. Also, even if cash was used, affidavits can be obtained or we can use industry standards to arrive at a reasonable figure. See Lost Documents.

If the IRS questions to you relate to Schedule C or Schedule E please purchase and follow the TaxHelpAudit Business Program. If the questions relate to any other Form or Schedule please purchase and follow the TaxHelpAudit Individual Program.

To see how the TaxHelp Programs work see our Empowerment page!

At any time you may consult with a tax attorney from TaxHelpLaw to get more specific tactics for your case!